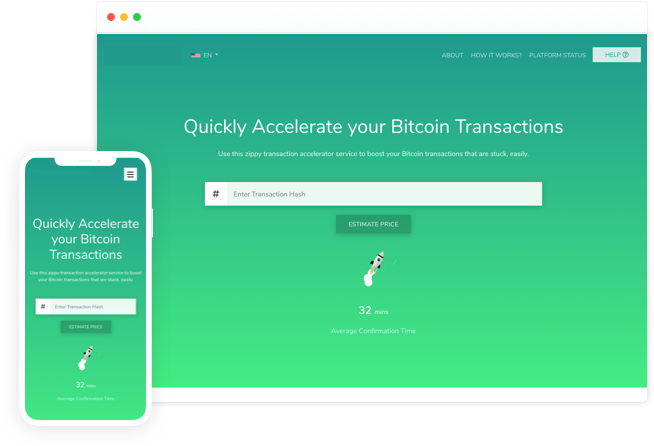

Nhập mã băm giao dịch

Sao chép và Dán mã băm của giao dịch bạn muốn tăng tốc.

Sao chép và Dán mã băm của giao dịch bạn muốn tăng tốc.

Để tăng tốc giao dịch, mạng sẽ xác định phí tăng tốc. Thanh toán nó để tăng tốc độ giao dịch. (Hoàn tiền 100% khi công việc không hoàn thành)

Nhập chi tiết về phí tăng tốc mà bạn đã trả để được tăng giá đặc biệt.

Giao dịch của bạn được đẩy lên Đầu hàng đợi để tăng tốc.

| Network Hashrate | |

| Network Difficulty | |

| Profit per TH/s | 0.00113859 BCH /1T/ Day ≈ $0.16 |

| Current best transaction fees | 0.00001 BCH/KB |

| Pending Transaction | |

| Pending Transaction Size | 16.57 K |

| 24h Tx Volume | 21102 txs |

| 24h Tx Rate | 0.24 txs/s |

| CoinEx | BCH/USD | $144.97 |

| Coinbase | BCH/USD | $144.93 |

| Bitfinex | BCH/USD | $144.87 |

| Bithumb | BCH/USD | $144.90 |

Published On: 02-Jan-2020, 08:17 AM IST

It is not bitcoin or ether, but tether which is the most traded cryptocurrency today. Commonly denominated as USDT, tether is a stable currency, which can be redeemed for a dollar. In other words, if one holds 100 USDT, they can redeem it for $100. There's even a BTC accelerator for boosting the transaction. Founded in 2014 by Brock Pierce, Reeve Collins, and Craig Sellars, tether is called a ‘stablecoin’ since it is pegged to the US dollar.

The need for tether came in when it was difficult for exchanges and companies to hold sovereign currency. In order to hold fiat money (sovereign currency) on behalf of the user, the exchange needed to have a license. The need was aggravated by the need for traders to be able to easily move between crypto and fiat. And thus tether was invented.

Traders use tether as a substitute for dollars. It can easily be transferred between exchanges or people with the help of BTC accelerator, instead of transferring money through banks. Tether is easy to buy and sell and is available at the place you buy your cryptocurrencies. Tether is also often used as a way to hold money on exchanges when traders feel the market is extremely volatile.

On the flip side, there is still a lot of criticism and skepticism when it comes to tether. People aren’t sure if all the tether issued is backed 100% by the US dollar or not. Also recently, $33 million tether was frozen due the KuCoin hack and this action showed that tether is a very centralized currency, which is against the decentralization thesis of the blockchain ecosystem. That said, it is still the most trusted and the oldest stablecoin in the crypto ecosystem.

Today, there is over $19 billion worth of tether in circulation. While tether is the biggest and the oldest stablecoin, there are more than 40 stablecoins trading, many being pegged to different sovereign currencies or gold, silver and special drawing rights (SDR). The popularity of tether gave rise to other stablecoins, which derive backing from various things. DAI, is a stablecoin issued by MakerDAO an exchange and in-built BTC accelerator. It is the first-ever project to introduce “decentralised finance" with the scope for BTC Accelerator. This means lending, borrowing and all the banking services can be performed without the need of an actual bank across borders. People would only need BTC accelerator to speed up transactions if they needed to send money faster.

The biggest competitor to tether is USDC, which is issued by Circle.com. The issuer claims that USDC is issued by regulated financial institutions and is backed by the US dollar in segregated bank accounts, and unlike USDT, also undergoes frequent and public audits to maintain its integrity.

This could increase USDC’s popularity over USDT with the recent introduction of STABLE ACT, a bill introduced in the US that would require stablecoin issuers to acquire banking charters, approval from the US Federal Reserve and hold Federal Deposit Insurance Corporation’s (FDIC) insurance.

An interesting use of stablecoins coming outside the crypto world is for cross-border purchase of goods and services. Many websites are now accepting stablecoins. These vary from online shopping to dating and gambling. Similar is the expected use of stablecoin and BTC accelerator from Facebook, Diem (formerly known as Libra), which is slated to be launched in the first or second quarter next year.

At least we can say safely that the USDT has changed the way we look at cryptocurrencies, ecommerce, payments, banking and even sovereign currencies.